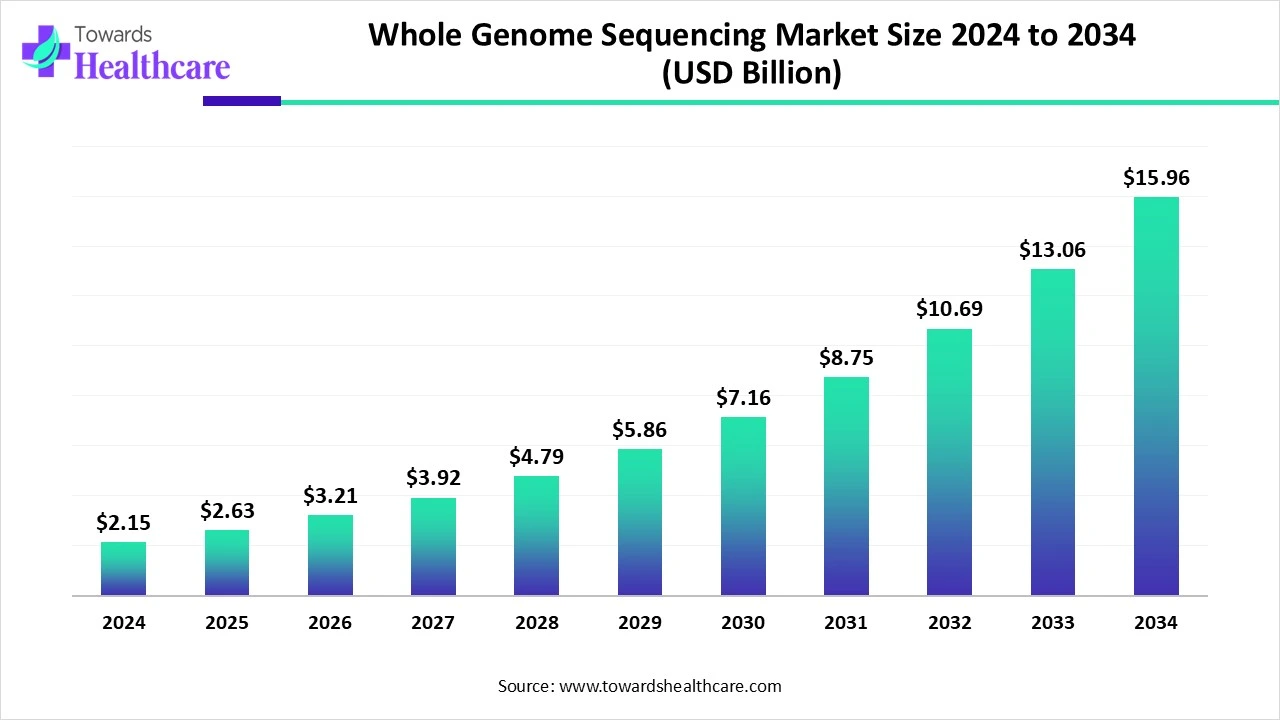

What USD 15.96 Billion Says About the Whole Genome Sequencing Market?

The global whole genome sequencing market size was valued at USD 2.63 billion in 2025 and is predicted to hit around USD 15.96 billion by 2034, rising at a 22.2% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Feb. 11, 2026 (GLOBE NEWSWIRE) -- The global whole genome sequencing market size is calculated at USD 3.21 billion in 2026 and is expected to reach around USD 15.96 billion by 2034, growing at a CAGR of 22.2% for the forecasted period.

Request your free custom sample and explore the Market data and insights | Download Now @ https://www.towardshealthcare.com/download-sample/5625

Key Takeaways

- Whole genome sequencing market to cross USD 2.15 billion in 2024.

- Market projected at USD 15.96 billion by 2034.

- CAGR of 22.2% expected from 2025 to 2034.

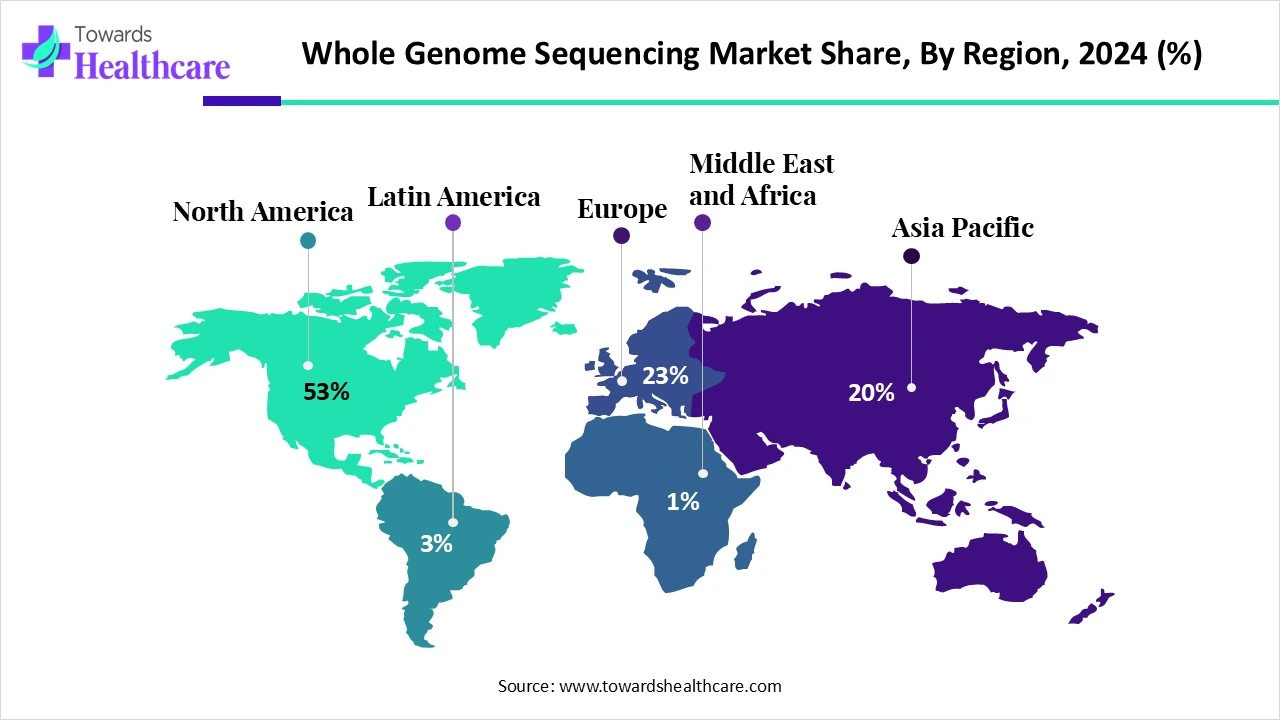

- North America accounted for the largest share of the market in 2024.

- Asia-Pacific is expected to grow rapidly during 2025-2034.

- By product & service, the consumables segment led the market in 2024.

- By product & service, the services segment is expected to grow at the fastest CAGR during the forecast period.

- By type, the large whole-genome sequencing segment dominated the whole genome sequencing market in 2024.

- By type, the small whole-genome sequencing segment is expected to witness rapid expansion in the upcoming years.

- By workflow, the sequencing segment registered dominance in the market in 2024.

- By workflow, the data analysis segment is expected to be the fastest-growing in the studied years.

- By application, the human whole genome sequencing segment dominated the market in 2024.

- By application, the microbial whole genome sequencing segment is expected to grow rapidly during 2025-2034.

- By end use, the academic & research institutes segment held a major share of the whole genome sequencing market in 2024.

- By end use, the hospitals& clinics segment is expected to witness the fastest growth in the predicted timeframe.

How is the Whole Genome Sequencing Transforming?

Mainly, the minimal sequencing expenditures, breakthroughs in NGS technology, and rising adoption in tailored medicine & oncology are impacting the overall progression of the whole genome sequencing market. Additionally, extensive developments in third-generation long-read sequencing platforms, including Oxford Nanopore Technologies (ONT) & PacBio SMRT, are developing ultra-long reads, which enable researchers to clear complex structural diversity.

What are the Drivers in the Whole Genome Sequencing Market?

One of the major drivers is ongoing substantial investments from the government and private sectors for genomic research & large-scale, population-level sequencing projects, which are fueling the global demand. The era is stepping towards clinical studies to offer novel, actionable diagnoses for over 25% of patients with rare or cancer-related issues using WGS.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Key Drifts in the Whole Genome Sequencing Market?

- In October 2025, Taiwan-based gene sequencing company Genomics BioSci & Tech joined with global sequencing leader Illumina to jointly explore gene sequencing & multi-omics technologies across the Asia-Pacific region.

- In August 2025, Sequencing.com and PGxAI partnered to revolutionize pharmacogenomics by integrating cutting-edge genomic perceptions with real-world healthcare applications.

- In April 2025, the Ministry of Social Affairs invested 4.9 million SEK in the innovation project BrAInChild to establish and execute advanced precision diagnostics for children with cancer.

What is the Vital Limitation in the Whole Genome Sequencing Market?

Highly generating data from WGS technology is demanding storage, high-performance computing, & specialized bioinformatics personnel to study, which raises a crucial logistical and financial burden. In some cases, data privacy, informed consent, & managing incidental findings are creating substantial ethical concerns.

Regional Analysis

How did North America Dominate the Market in 2024?

In 2024, North America held a dominant share of the market due to expanding demand for customized medicine and immersive large-scale projects, such as the U.S. NIH’s All of Us Research Program. Recently, >15,000 genomes from HostSeq and BQC19 were combined into the PCGL, which develops a centralized national resource for COVID-19 & other research.

For instance,

- In August 2025, Ultima Genomics, Inc. and Gene by Gene partnered to widen global access to high-quality, affordable DNA sequencing.

How did the Asia Pacific Grow Notably in the Market in 2024?

During the prospective period, the Asia Pacific is estimated to expand rapidly in the whole genome sequencing market. This is reinforced by consistent government incentives in national genome projects, especially by China, Japan, Singapore & India to support precision medicine and advance healthcare infrastructure. A recent study, powered by Peking Union Medical College Hospital and led by BGI Genomics, evaluated 94,749 individuals across 42,703 families, developing a new diagnostic landscape for rare diseases in China.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights

By product & service analysis

Why did the Consumables Segment Lead the Market in 2024?

The consumables segment captured a dominant share of the whole genome sequencing market in 2024. This mainly encompasses library preparation kits, reagents, and flow cells, and ongoing efforts into rapid, more accurate next-generation sequencing (NGS) are driving demand for these consumables. QIAGEN QIAseq multimodal DNA/RNA library kit is enabling comprehensive, simultaneous preparation of RNA and DNA libraries for combined WGS & transcriptome studies.

Moreover, the services segment will expand fastest. This is fueled by the incorporation of library preparation, high-throughput sequencing, & bioinformatics data analysis. However, leading firms are employing AI for variant annotation, pathogenicity prediction, & escalating data analysis, like Illumina's DRAGEN, & BioAro’s PanOmiQ. Also, Pacific Biosciences (PacBio) Revio & Oxford Nanopore platforms are using long-read technology service to settle complex structural variants & repetitive regions that lack short-read methods.

By type analysis

Which Type Dominated the Whole Genome Sequencing Market in 2024?

The large whole-genome sequencing segment was dominant in the market in 2024. This is a prominent tool in research and clinical diagnostics, which assists in determining single-nucleotide variants (SNVs), structural diversity, copy number alterations, and repeat expansions. Recently, Tohoku Medical Megabank Organization (TMM) completed WGS on 100,000 samples, with data release & refined reference panels (TMM-61KJPN) continuing into the era.

However, the small whole-genome sequencing segment is estimated to witness rapid growth. By integrating with NGS, this enables the expedited, comprehensive, and culture-free analysis of complete microbial genomes. Its progression is impelled by the increasing need for affordable, rapid-turnaround pathogen surveillance and antimicrobial resistance (AMR) monitoring. Nowadays, companies are emphasizing evolving simultaneous multiplexing of samples, boosted pathogen surveillance, & enhanced determination of resistance genes.

By workflow analysis

How did the Sequencing Segment Lead the Market in 2024?

In 2024, the sequencing segment held a major share of the whole genome sequencing market in 2024. This workflow is exploring DNA extraction, purification, fragmentation, and adapter ligation. Also, the market is leveraging NGS platforms and automation in liquid handling to lower human error & raise turnaround times. Organizations are leveraging the Human Pangenome Reference, which is more extensive in worldwide genetic variations than single-genome models.

Furthermore, the data analysis segment is predicted to register the fastest expansion. This mainly implements primary, i.e., signal processing, secondary, like alignment/variant calling, and tertiary, including annotation/interpretation analysis, with cloud-based, & automated AI tools. To detect structural variants (SV) & copy number variation (CNV), firms are using tools, especially Manta or DELLY, to find large rearrangements, which are highly crucial for cancer genomics.

By application analysis

Which Application Dominated the Whole Genome Sequencing Market in 2024?

The human whole genome sequencing segment registered dominance in the market in 2024. It has substantial benefits, such as quicker, more precise diagnosis of rare, undiagnosed, or genetic diseases, tailored treatment plans, and proactive health risk management. Recently, the Indian government announced the successful sequencing of 10,000 genomes, unveiling the Indian Biological Data Centre (IBDC) to offer access to this data for research.

Furthermore, the microbial whole genome sequencing segment will show rapid expansion. This primarily supports detecting escalated pandemic surveillance, accurate finding of antimicrobial resistance (AMR), and optimized pathogen tracking in clinical, environmental, & food safety sectors. The latest efforts have used detailed, long-read Nanopore sequencing to recover genomes from over 15,000 early unknown microbial species from soil & sediment.

By end-use analysis

How did the Academic & Research Institutes Segment Dominate the Market in 2024?

The academic & research institutes segment led the whole genome sequencing market in 2024. Continuous studies in genetic disorders, developments, epigenetics, and ongoing funding encouragement, such as the All of Us Research Program & population-scale studies, like the IndiGen project in India, are impacting the adoption of WGS. Additionally, researchers from the Indian Institute of Science (IISc) & Central University of Tamil Nadu (CUTN) demonstrated India’s first T2T plant genome (Basmati rice) & T2T human genome.

On the other hand, the hospitals& clinics segment is predicted to expand rapidly. They are increasingly stepping towards customized treatment and are boosting demand for advanced WGS. Whereas, China’s PUMCH hospital introduced "PUMCH-GENESIS," an AI model for rare disease diagnosis, while Children’s Hospital Colorado unveiled an in-house WGS laboratory to speed up diagnostics.

Let’s grow together as trusted research partners: https://www.towardshealthcare.com/schedule-meeting

Recent Developments in the Whole Genome Sequencing Market

- In January 2026, seqWell launched the AgriPrep Library Prep Kit for low coverage whole genome sequencing.

- In October 2025, the Center of Excellence in Medical Genetics, Faculty of Medicine, Chulalongkorn University, introduced one of the world's first projects to conduct long-read whole genome sequencing in newborns.

- In September 2025, Lenovo implemented GOAST v4.0 to lower genome sequencing time to 24 minutes.

Key Players List

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Oxford Nanopore Technologies

- Pacific Biosciences of California, Inc.

- BGI

- QIAGEN

- Agilent Technologies

- ProPhase Labs, Inc.

- Psomagen

- Azenta US, Inc. (GENEWIZ)

Browse More Insights of Towards Healthcare:

The genome editing market is expected to grow from USD 10.98 billion in 2025 to USD 52.56 billion by 2035, with a CAGR of 16.95% throughout the forecast period from 2026 to 2035.

The global genomics market size is projected to reach USD 198.99 billion by 2035, expanding from USD 44.72 billion in 2025, at an annual growth rate of 16.1% during the forecast period from 2026 to 2035, as a result of rising technology advancements and increasing demand for personalized medicine.

The genomics data analysis market size was reported at US$ 7.95 billion in 2025 and is expected to rise to US$ 9.18 billion in 2026. According to forecasts, it will grow at a CAGR of 15.45% to reach US$ 33.51 billion by 2035.

The global genomic urine testing market size is calculated at US$ 148.23 in 2024, grew to US$ 160 million in 2025, and is projected to reach around US$ 319.14 million by 2034. The market is expanding at a CAGR of 7.94% between 2025 and 2034.

The global genome sequencing market size is calculated at US$ 22.63 in 2024, grew to US$ 26.31 billion in 2025, and is projected to reach around US$ 101.93 billion by 2034. The market is expanding at a CAGR of 16.24% between 2025 and 2034. Genome sequencing is highly essential for genetic engineering, studying genetic disorders, and developing therapeutics, which is promoting the growth of the genome sequencing market.

The global genomics life science analytics market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

The global metagenomics market size is calculated at US$ 2.68 billion in 2025, grew to US$ 3.04 billion in 2026, and is projected to reach around US$ 9.55 billion by 2035. The market is expanding at a CAGR of 13.55% between 2026 and 2035.

The global precision medicine market size is calculated at USD 118.52 billion in 2025, grow to USD 137.9 billion in 2026, and is projected to reach around USD 538.83 billion by 2035.The market is expanding at a CAGR of 16.35% between 2026 and 2035.

The global clinical genomics market size is calculated at US$ 1.06 in 2024, grew to US$ 1.25 billion in 2025, and is projected to reach around US$ 5.34 billion by 2034. The market is expanding at a CAGR of 17.54% between 2025 and 2034.

The AI in genomics market size is forecast to grow at a CAGR of 23.6%, from USD 1.67 billion in 2025 to USD 13.88 billion by 2035, over the forecast period from 2026 to 2035, as a result of growing cross-industry collaborations and increasing R&D.

Segments Covered in the Report

-

By Product & Service

- Instruments

- Consumables

- Services

-

By Type

- Large Whole Genome Sequencing

- Small Whole Genome Sequencing

-

By Workflow

- Pre-sequencing

- Sequencing

- Data Analysis

-

By Application

- Human Whole Genome Sequencing

- Plant Whole Genome Sequencing

- Animal Whole Genome Sequencing

- Microbial Whole Genome Sequencing

-

By End Use

- Academic & Research Institutes

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Others

-

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- North America

Immediate Delivery Available | Checkout This Premium Research @ https://www.towardshealthcare.com/checkout/5625

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Read Further:

https://www.towardshealthcare.com/insights/optical-genome-mapping-market-sizing

https://www.towardshealthcare.com/insights/consumer-genomics-market-sizing

https://www.towardshealthcare.com/insights/metagenomic-sequencing-market-sizing

https://www.towardshealthcare.com/insights/rapid-genomic-diagnostics-market-sizing

https://www.towardshealthcare.com/insights/sequencing-consumables-market-sizing

https://www.towardshealthcare.com/insights/sequencing-market-sizing

https://www.towardshealthcare.com/insights/dna-sequencing-market-sizing

https://www.towardshealthcare.com/insights/mirna-sequencing-and-assay-market-sizing

https://www.towardshealthcare.com/insights/next-generation-sequencing-market-sizing

https://www.towardshealthcare.com/insights/us-next-generation-sequencing-market-sizing

https://www.towardshealthcare.com/insights/long-read-sequencing-market-sizing

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.